At the second IEEE World Forum on the Internet of Things in Milan, Italy, Roberto Minerva of Telecom Italia gave a keynote speech covering everything IoT from the perspective of a telecom operator. Among the topics discussed was the inevitable question of “control of data”. Who should control your personal data? How should your personal data be used? Telecom Italia surveyed Italian families concerning whether they’d accept information from within their household to be shared, and the answer, unsurprisingly, was a resounding NO!

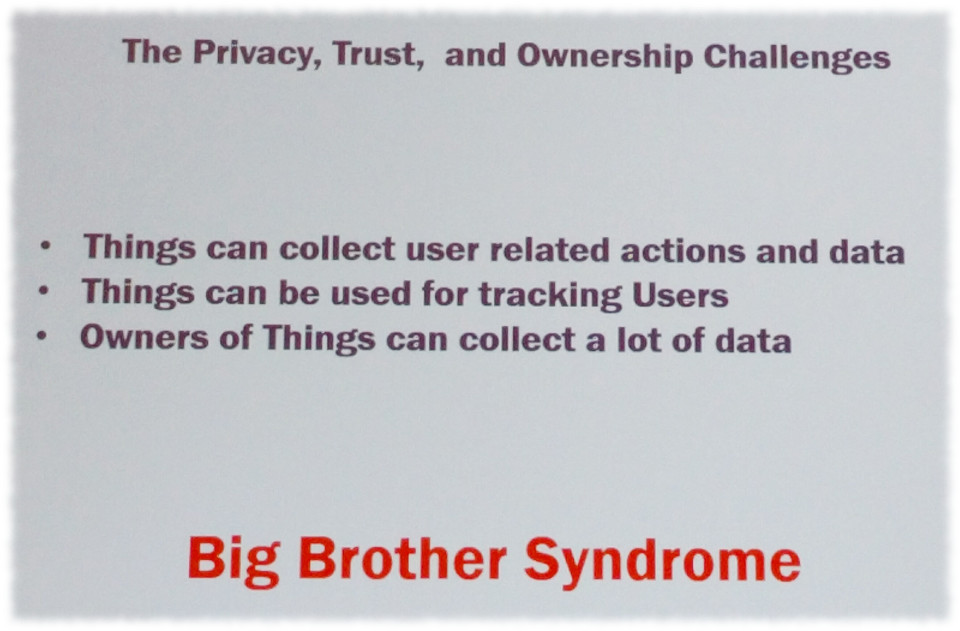

The comprehensive presentation could be described as technically optimistic and practically pessimistic. This is characteristic of many of the European views we’ve observed, for instance that of Mikko Hypponen, which place a high emphasis on privacy and lament the amount of personal data and communications which inevitably pass through servers in the United States, subject to their surveillance apparatus. In other words, while the sharing of information in the IoT is encouraged, the existing mechanisms are strongly criticised.

Curious to explore this point further, we asked Dr. Minerva:

Do you see a means for individuals to retain control of their personal data yet share it securely and opportunistically?

His eyes seemed to brighten as he indicated that this was indeed a topic much discussed within his organisation. He explained that there’s a model not unlike that of a bank, where instead of placing money, you place your data:

You put your money in a bank, and the bank acts as a broker for you, investing your money as you see fit. But the money always belongs to you. Of course this is not always the case in Italy…

The audience laughed.

Indeed the banking model for personal data in the IoT has promise. It’s something we’ve explored at reelyActive. In February, George Koulouris collaborated with us to prototype a personal data locker which allows users to own and sell their information. However, technical feasibility alone will not be sufficient to get personal data banking off the ground.

We therefore speculate on how personal data banking may emerge. Will an entity such as Facebook, with the information of billions of individuals in its coffers, adopt such a model? Today one could argue that Facebook better resembles the Italian banking system that Dr. Minerva joked about! Will a disruptive startup create and define this next billion dollar industry? Will the individuals of the world unite and together control the means of personal data distribution?

In fact, only time will tell. But one thing is certain: unlocking the claimed $3.7 Trillion market opportunity for improving customer experiences will require the emergence of something along the lines of a personal data banking industry.

Comments

One response to “The Bank of Personal Data”

[…] we’re not alone in asking that question. In The Bank of Personal Data we discussed how Dr. Roberto Minerva, like us, argues for a broker model. And when you consider how […]

LikeLike